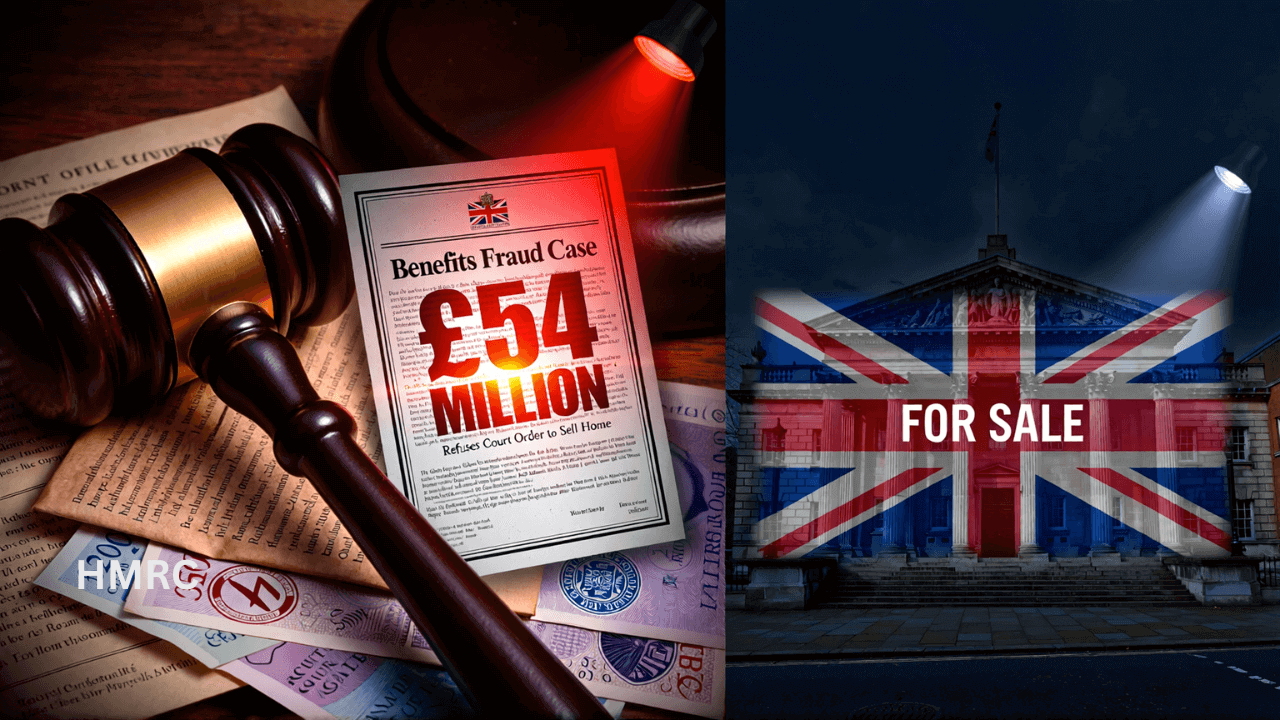

A high‑profile benefits fraud case has returned to the spotlight after a migrant convicted of large‑scale fraud reportedly refused to comply with a court order requiring the sale of a property to help repay £54 million owed to the UK state. The case has reignited debate around benefit fraud enforcement, asset recovery and the challenges authorities face when reclaiming public money.

The refusal has drawn strong reactions from both the public and policymakers, particularly at a time when scrutiny of welfare spending and fraud prevention remains intense. While benefit fraud represents a small proportion of total welfare expenditure, cases involving extremely large sums tend to attract significant attention and raise questions about deterrence, fairness and enforcement.

This article explains what is known about the case, how benefit fraud recovery works, why courts order asset sales, and what the refusal could mean going forward.

Why this benefits fraud case has drawn attention

Most benefit fraud cases involve relatively modest sums, often linked to incorrect declarations or failure to report changes in circumstances. A case involving an alleged £54 million repayment is therefore highly unusual.

The scale of the figure has made the case one of the most closely watched benefit fraud matters in recent years, with wider implications for how the UK tackles serious abuse of the welfare system.

What the court order requires

Following conviction, courts can issue confiscation orders under proceeds of crime legislation. These orders are designed to recover money or assets obtained through criminal activity.

In this case, the court reportedly ordered that a property owned by the individual be sold, with proceeds used toward repaying the outstanding amount owed to the state.

Why selling property is ordered in fraud cases

When large sums are involved, courts often look beyond bank balances and income. Property, investments and other high‑value assets may be targeted as part of asset recovery.

Selling property is seen as a way to ensure repayment when liquid funds are insufficient or inaccessible.

The refusal to comply with the court order

Reports indicate that the individual has refused to comply with the order to sell the home, creating a legal standoff. Such refusals do not cancel the obligation but can complicate enforcement.

Courts have powers to respond to non‑compliance, but the process can be lengthy and legally complex.

What happens when someone refuses to sell assets

Refusing to comply with a confiscation order can lead to further court action. This may include additional penalties, interest accruing on the amount owed, or further enforcement measures.

In some cases, custodial sentences can be extended if courts determine that non‑compliance is deliberate.

The role of proceeds of crime laws

The UK uses proceeds of crime legislation to recover money gained through criminal activity, including serious benefit fraud. These laws allow authorities to pursue assets even after a prison sentence has been served.

The aim is to ensure that crime does not pay, regardless of how long recovery takes.

Why asset recovery can be difficult

Recovering large sums is often challenging, particularly when assets are tied up in complex ownership structures or when individuals resist compliance.

Legal appeals, disputes over ownership and valuation issues can significantly delay the process.

Public reaction to the case

The case has triggered strong reactions, particularly among taxpayers who view benefit fraud as an abuse of public trust. Many see refusal to comply with court orders as an aggravating factor.

Others caution that legal processes must still be followed carefully to avoid errors or miscarriages of justice.

The wider debate about benefit fraud

Benefit fraud remains a politically sensitive topic. Governments frequently stress the importance of protecting public funds while also ensuring genuine claimants are supported.

High‑value cases often influence public perception, even though they represent a tiny fraction of overall benefit spending.

How common large‑scale benefit fraud is

Cases involving tens of millions of pounds are extremely rare. Most fraud investigations involve much smaller sums accumulated over time.

Authorities emphasise that large figures often reflect long‑running schemes rather than single fraudulent claims.

The impact on migration and benefits debates

Because the case involves a migrant, it has intersected with wider debates around migration, eligibility and enforcement. Politicians from across the spectrum have weighed in cautiously.

Officials stress that benefit fraud laws apply equally regardless of nationality or background.

Why courts focus on repayment as well as punishment

Punishment alone does not restore public funds. Confiscation and repayment are central to ensuring that taxpayers are not left bearing the cost of fraud.

Courts aim to balance punishment with recovery, particularly in high‑value cases.

What happens if the full amount cannot be recovered

If the full £54 million cannot be recovered immediately, the debt does not simply disappear. Outstanding amounts can remain enforceable for years.

Interest may continue to accrue, increasing the total owed over time.

How enforcement agencies pursue compliance

Enforcement agencies can apply for further court orders to seize assets, appoint receivers or take control of property sales.

These processes are designed to bypass non‑cooperation where possible.

Legal rights of the individual involved

Even in high‑profile cases, individuals retain legal rights, including the right to appeal orders and challenge valuations. Courts must ensure procedures are lawful and proportionate.

This can slow enforcement but is a fundamental part of the legal system.

Why property disputes are common in confiscation cases

Property often carries emotional as well as financial value. Disputes may arise over family members’ interests, mortgages or residency issues.

Courts must carefully assess these factors before enforcing sales.

The message authorities want to send

Officials say cases like this are intended to send a clear message that serious benefit fraud will be pursued relentlessly, even years after conviction.

The refusal to comply is seen as reinforcing the need for strong enforcement powers.

Concerns about delays in recovery

Critics argue that long delays in recovering money undermine public confidence. They call for faster, more decisive enforcement in high‑value cases.

Authorities counter that due process is essential to avoid legal errors.

How this case could set a precedent

The outcome may influence how future high‑value benefit fraud cases are handled, particularly where individuals resist asset recovery.

Courts may clarify the consequences of refusal more explicitly.

What genuine benefit claimants should understand

Officials stress that genuine claimants should not feel targeted or stigmatised by high‑profile fraud cases. The vast majority of benefit recipients claim lawfully.

Enforcement focuses on deliberate, large‑scale abuse.

The financial scale in context

While £54 million is a striking figure, it represents a tiny fraction of total annual welfare spending. Authorities warn against drawing broad conclusions from exceptional cases.

Context remains important in public debate.

Ongoing legal proceedings

The case is expected to continue through further legal proceedings as authorities seek to enforce the court order. Outcomes will depend on judicial decisions rather than public pressure.

Updates are likely as hearings progress.

Why accurate reporting matters

High‑value fraud cases often generate exaggerated claims and misinformation. Clear reporting helps the public understand what has actually been ordered and what remains unresolved.

Speculation can distort understanding.

What happens next

If the refusal continues, courts may escalate enforcement measures. Alternatively, negotiations or legal challenges could alter the timeline.

The final outcome remains uncertain.

Key points to remember

A migrant convicted in a major benefit fraud case has reportedly refused to comply with a court order to sell a home to help repay £54 million. The refusal does not remove the obligation and may lead to further legal consequences.

Asset recovery processes are complex and can take years.

Final thoughts

The benefits fraud case involving a £54 million repayment highlights both the seriousness with which authorities pursue large‑scale fraud and the difficulties involved in enforcing recovery. While the refusal to sell property has intensified scrutiny, the legal process continues to unfold within established frameworks.

For the public, the case serves as a reminder that serious benefit fraud carries long‑term consequences that extend well beyond prison sentences. For policymakers, it underscores the ongoing challenge of balancing robust enforcement with fair and lawful procedure. As the case develops, it is likely to remain a focal point in debates around welfare integrity, justice and accountability.